(K. Warner’s article from the METAL TECH NEWS on 12 November 2024.)

Myanmar REE mining halts, prices soar: Half the

world's heavy rare earth production grinds to a halt amidst civil war. Myanmar's

top exports have long been oil and natural gas, followed by fruits and

vegetables, wood, fish, clothing, and rubber. Its main export partnerships are

with China, India, Japan, South Korea, Germany, Indonesia and Hong Kong.

Today, this small country has found itself to be an

essential source of heavy rare earth elements (HREEs), vital ingredients for

the magnets used in electric vehicles and renewable energy wind turbines

worldwide.

With countries scouring their own backyards for resources, Myanmar's geological wealth has caught the eye of battery-producing world powers; as much as 50% of the global heavy rare earths supply has come from the small country's mines directly to China, controlling almost 90% of global rare earth processing, backed by 60% of global production.

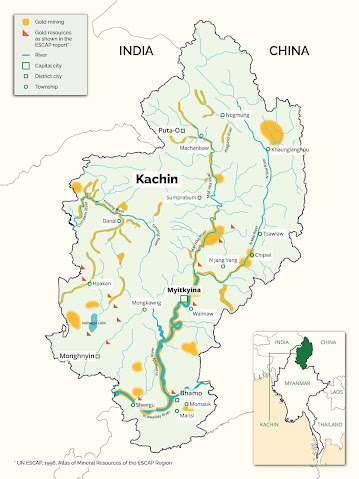

Most of Myanmar's HREEs originate from Kachin,

bordering China. The state has suffered decades of civil war between the

Myanmar military and ethnic communities struggling for greater political

autonomy.

Amid the ongoing conflict, the Kachin Independence

Army managed to overrun a leading mining center in mid-October of this year, a

hub that includes production sites in Pang War, Chipwi, Phimaw and Hsawlaw,

with Chinese media reporting that mining operations have effectively been

halted.

The takeover of Myanmar's most prolific rare earth

mines has disrupted the global supply chain, with China imposing a trade

embargo in response to the seizure, further exacerbating the shortage of rare

earth minerals and driving prices up. While operations remain suspended, supply

is dwindling.

Previously, rare earth mining areas in Kachin state were under the control of government-allied militia group NDA-K, which welcomed payments from Chinese companies looking to establish mines.

According to Myanmar news sources, during military

operations, KIA the Kachin Independence Army occupied Pang War – hosting the

largest rare earth mine in Myanmar – in October. China retaliated with a trade

embargo on Myanmar, cutting off electricity and imports of essential goods

including fuel and foodstuffs. Locals said that most of the rare earth mining

had to be suspended after China's closure of the border and import ban.

Last year, Myanmar exported approximately 50,000

metric tons of rare earth oxides (REOs) from ion-adsorption clays to China,

surpassing China's domestic IAC mining quota of 19,000 tons and positioning

Myanmar as the leading global exporter of heavy REOs according to broker Ord

Minnett.

Last month, China halted rare earth imports from

Myanmar and suspended exports of ammonium sulfate used to leach rare earths

there due to the conflict. The Kachin Independence Army is expected to

"resume the REO business provided China is prepared to accept the exports

and supply the technicians and ammonium sulphate. But I reckon it will expect

payments before letting the companies do so," according to Ord Minnett

analyst Matthew Hope. "Once the conflict passes, we expect financial deals

with Chinese miners will be renegotiated, likely delaying restarts until

early-2025," Hope said.

The combination of these factors will likely lead

to a period of price consolidation shortly followed by a rise as the market

absorbs the impact of reduced supplies and potential trade restrictions.

Reports of disturbing developments around Myanmar's mostly unregulated

extraction of heavy rare earth elements may also figure into future supply and

pricing concerns.

Kachin resistance takes control of rare earth mining hub

(Staff article from the DVB on 21 October 2024.)

The Kachin Independence Army (KIA) and its allied

People’s Defense Force (PDF) took control of Pangwa, which is located along the

China-Burma border and 114 miles (183 km) northeast of the Kachin State capital

Myitkyina, on Saturday. Pangwa is the capital of the Kachin Special Region 1,

which is administered by the Kachin Border Guard Force (BGF).

Pangwa residents said that a cordon has been set up

50 meters from the border gate on Oct. 18, but that Chinese nationals have been

allowed to enter for work. “The civilians who fled the town are stuck along the

road to the China border,” an anonymous source in the KIA told DVB. Naw Bu, the

KIA spokesperson, said that Chinese authorities issued a letter stating that

all border gates would be temporarily closed.

The KIA seized the 1002 Battalion near Pangwa in

Chipwi Township from the BGF on Oct. 14. It also seized control of the mining

towns of Hsawlaw and Chipwi earlier this month. The Kachin Special Region 1 is

a hub for Burma’s lucrative rare earth mining, which was reportedly worth $1.4

billion USD last year.

(To punish KIA for capturing Chinese rare-earth mines China has shut down the border gates. As a response to China’s blockading of

Kachin border gates from the Chines side, KIA has welded-shut the Panwar border

gate and blocked the convoy of Chinese trucks trying to transport the

rare-earth minerals from Myanmar to China, and the effect has shocked the

international rare-earth markets.)

KIA takes control of Myanmar rare earth mining hub

(Staff article from the STRAITS TIMES SINGAPORE on 23 October 2024.)

An armed group fighting Myanmar's ruling military

said it has taken control of a mining hub that is a major supplier of rare

earth oxides to China, likely disrupting shipments of elements used in clean

energy and other technologies.

Rare earth mining in Myanmar is concentrated in

Kachin state around the towns of Panwa and Chipwe, adjacent to southwestern

China's Yunnan province. The Kachin Independence Army (KIA) took control of

Panwa on Oct. 19, spokesperson Colonel Naw Bu told Reuters on Tuesday. It had

previously captured Chipwe, according to local Myanmar media. Reuters was not

able to independently verify the status of both towns.

The KIA is focused on managing the town of Panwa

and has no current plans for rare earths or other economic issues, Naw Bu said.

He did not respond when asked whether the KIA is open to working with China on

rare earths.

Previously, rare earth mining areas in Kachin state

were under the control of militia group NDA-K, which is allied with Myanmar's

junta government and welcomed payments from Chinese companies looking to

establish mines.

Last year, Myanmar supplied China with about 50,000 metric tons of rare earth oxides (REOs) from ion-adsorption clays (IACs), eclipsing China's domestic IAC mining quota of 19,000 tons and making it the world's top exporter of heavy REOs, according to broker Ord Minnett.

"Rebel control of these mining sites could

potentially disrupt rare earth concentrate shipments into China, which have

declined for four months straight owing to the monsoon season and other

challenges," research firm Adamas Intelligence said in a note on Monday.

China is the world's biggest consumer and importer

of rare earth ores and compounds, which it uses to produce refined rare earth

and magnets, industries it dominates. Last month, China halted rare earth

imports from Myanmar and suspended exports of ammonium sulphate used to leach

rare earths there due to the conflict, said Ord Minnett analyst Matthew Hope.

"I expect the KIA plans to resume the REO

business provided China is prepared to accept the exports and supply the

technicians and ammonium sulphate. But I reckon it will expect payments before

letting the companies do so," Hope said.

"Once the conflict passes, we expect financial

deals with Chinese miners will be renegotiated, likely delaying restarts until

early-2025," he said, adding that prices for REOs used in magnets are

likely to rise as supply tightens.