The world is sitting at the edge of a massive deflationary cliff. Even though Central Banks are desperately trying to keep the world’s financial assets from plunging down into the great depression below, signs suggest they are losing the battle.

One critical sign is the peak and decline of International Reserves. Hugo Salinas Price has been keeping an eye on International Reserves for quite some time. In his recent article, A Reversal In The Trend Of International Reserves, he stated the following:

International Reserves peaked on August 1, 2014, at $12.032 Trillion dollars, and as of October 28, 2016 they stood at $11.066 Trillion dollars.

International Reserves stood at about $10 Trillion in 2011, but the rate of growth slacked off; the weekly increases in Reserves (which Bloomberg used to publish every Friday) stalled and became smaller, week by week. As mid-2014 came around, the increases were quite small.

It was clear that the trend was for ever-smaller increases, and that could only mean that finally there would be no increase, which would be immediately followed by decreases in the total of International Reserves held by Central Banks. That is exactly what took place.

Here is a chart of International Reserves from Hugo Salinas Price’s article:

Hugo Salinas Price explains in the article, “that the increases of International Reserves take place when the Reserve Currency issuing countries effect payments to the rest of the world.” Basically, countries such as the United States that run trade deficits, exchange fiat money or Treasuries for goods from other countries. This shows up as an increase in International Reserves.

Now, what is important to understand about the chart above is the timing of the PEAK & DECLINE of International Reserves. I had an email exchange with Mr. Salinas on what I believe was the leading factor in why the International Reserves peaked and declined.

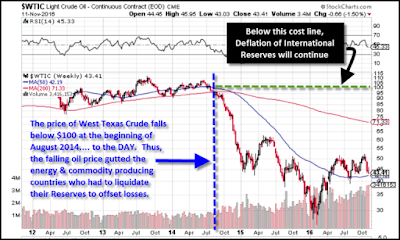

When I went back and looked at a five-year price chart of a barrel of oil (West Texas), I found a very interesting coincidence:

The price of a barrel of West Texas Crude fell below $100 starting at the beginning of August, 2014…. TO THE DATE. Even though the oil price had traded between $85-$100 over the past three years, it averaged over $95. However, by the end of 2014, it had fallen by more than half.

This had a profound impact on International Reserves as the low oil price gutted the energy-commodity-goods producing countries. These are the countries that hold the majority of International Reserves. So, as the price of oil continued to stay below $50 a barrel, these countries had to sell Bonds and acquire cash to fund their own domestic account deficits.

Thus, the peak and decline of International Reserves occurred right at the same time, the peak and decline of high oil prices. THIS IS NO COINCIDENCE.

As Hugo Salinas Price’s chart above shows, the world has experienced massive asset inflation ever since President Nixon dropped the Gold-Dollar peg in 1971. Furthermore, it isn’t a coincidence that the U.S. Debt went up in a similar exponential trend the same as International Reserves since 1971:

The reason for the massive increase in U.S. debt shown in the chart above was due to the falling EROI – Energy Returned On Investment of U.S. Oil & Gas. When the United States enjoyed an EROI of 30+/1 (prior to 1971), its debt remained low… relatively speaking. However, as the U.S. Oil & Gas EROI continued to decline, its public debt skyrocketed. Part of this U.S. debt is included as International Reserves.

Basically, the United States (and other countries) could no longer afford to sustain their domestic economies with their own energy sources, so they had to import energy (commodities-goods) to continue business as usual. These trade or account deficits resulted in the exponential increase of International Reserves.

Unfortunately, the peak and decline of International Reserves represents the POPPING OF THE MASSIVE INFLATIONARY ASSET BUBBLE. This is due to the falling oil price as well as the rapidly declining net energy in a barrel of oil.

Hugo Salinas Price is one of the few spokesmen in the precious metals community that understands the dire implications of the declining global oil industry. He translated my Big Trouble At ExxonMobil article in Spanish on his website: Toca a su fin la época de la gran industria petrolera americana. ExxonMobil tiene enormes problemas.

While the Mainstream media is completely clueless to the disaster

currently taking place in the Global Oil Industry, most in the precious

community are oblivious as well. This is

due to the fact that most analysts in the precious metals community have

BLINDERS on. They just rather focus on

the direct impact of gold and silver, and nothing else. This is quite a shame as ENERGY is the KEY.